If you want to binge-watch Netflix TV shows or want to enjoy the upcoming web series on amazon prime all you need to pay for these services via credit card as these are international services. They don’t accept the amount in local Pakistani currency, so in this scenario, you need to own a credit card to pay for them.

Amazon, eBay and Alibaba:

Similarly, if you have to buy something online via amazon, EBAY or Alibaba you need to have a working credit card at your disposal which should have the required amount of cash in your account so you may be able to pay.

While using the internet you must have come across different apps or services which require you to pay via credit card. Or they require you to pay via PayPal which is an American service and unfortunately doesn’t work in Pakistan.

Also, most of us are fond of listening to music, especially youngsters. If you are a teenager who has just crossed 18 years and doesn’t have access to a bank to open an account and apply for a credit card service so that you can pay for your favorite streaming service and starts enjoying the content then this article is especially for you.

Opening a bank account may be a tedious process:

Opening a bank account is a hectic process. You need to provide a lot of documentation along with proof of your income and in case if you haven’t any sort of regular job and you’re currently depending upon tuition and other odd sources of income then it would be arduous for you to open a bank account.

If you are a bank user and own a credit card it may sound too easy for you to just activate your credit card service and pay to an online store or service via it.

But what if you don’t have a credit card or a bank account to pay for but still want to pay for the desired online service, so don’t be hopeless, we have got your back.

Credit cards – But how do they work?

A credit card works by allowing the cardholder to borrow money from the issuing bank up to a set limit, or credit limit. The borrowed funds can then be used to make purchases or cash withdrawals at businesses that accept the card. After the cardholder makes a purchase, the merchant notifies the issuing bank of the transaction information to obtain authorization. If the cardholder has enough credit to cover the purchase, the bank will confirm this.

If the cardholder has sufficient credit, the bank will authorize and complete the transaction. The borrowed amount, as well as any fees or interest that may have accrued, is then due by the cardholder at a later date. Every month, the cardholder receives a statement from the bank detailing the purchases and payments made during the previous month.

Virtual card -An alternative to traditional credit card

If you are living in Pakistan, you may be familiar with the services like Easypaisa JazzCash and other HBL Konnect. These services are great for sending and receiving money across Pakistan.

These services provide alternatives to traditional banking services which include bill payment and local online payment within Pakistan. But they don’t provide a solution for international payments for which you have to consult a nearby bank and open an account. Even though there are payment gateways initiated by the Government of Pakistan such as RAAST, but again these only provide solutions to local payment and do not provide any online solution.

This is where Nayapay comes into form, providing a complete solution. At first glance, this app looks identical to what Easypaisa and JazzCash have to offer but it has more to offer.

As we have said, the Nayapay app is something different from the traditional money transfer app. It provides a complete solution ranging from online bill payment to sending money to your contact lists just like WhatsApp but what excites us most is its ability to provide a virtual credit card aka VISA VIRTUAL, completely free of cost. which is its main feature. Similarly, it also provides us with a physical debit card namely a visa physical without spending a penny.

This free visa physical card can be used at multiple Points of sale in Pakistan.

NAYAPAY Visa Virtual card? Why should I have one?

A virtual card is similar to a physical debit card except that it exists entirely on your smartphone. You will receive your virtual card on the NayaPay app as soon as your wallet is created. You can use your virtual card for online transactions, whether it be a one-time purchase at an e-commerce site or a recurring subscription.

You can control the card entirely through the app, including setting spending limits, freezing the card, and enabling and disabling international payments.

Why Choose a Virtual Card over a Traditional Credit card?

- No fear of Online fraud:

Most people having credit cards fear online fraud as credit card crimes are easy to perform and if your credit card is linked to your main salary account, such as

Habib Bank Limited, Bank Alfalah or National bank of Pakistan, you can fall into serious trouble.

Due to this reason, most people avoid using their main credit card at online checkout due to fear of their banking information being leaked.

But in Nayapay, you will get a free visa virtual card which will not be linked to your main bank account. And you can use it everywhere online since the app’s intuitive design offers easy control over your online spending and can limit your spending to avoid being robbed online, also it has the option to freeze your card if you are too paranoid about unauthorized access to your card.

- Freeze your card with a single tap:

The service also offers you to issue another visa virtual card if for any reason your card is misused and you want to block and issue another virtual card, which comes very handy in case of a bank account there is a hectic process involved.

- Re-issuing another virtual card is so easy:

To block and re-issue another card but in this case, since it’s an online and virtual card specifically designed for online payments, things become too comfy. All you have to do is to open the app, block your existing card, and order another card virtual card for a small fee, without going to any bank branch.

- No Overspending:

Since traditional credit cards are linked to your bank account. Most of the time, they can easily provide you with easy loans and EMI which for the current moment is a great facility to avail but ultimately it may lead you towards a debt trap if repayment is not made on time.

On the other hand, the visa virtual card allows paying only if you have the required amount in your wallet which in most cases will prevent you from overspending.

- No Interest Charges:

By using a traditional card, you have to pay interest on each of your transactions, which may cost you a financial burden if you have to pay via credit card less often.

But the service offered by Nayapay is marvellous as it currently doesn’t deduct any interest rates or other hidden charges.

- No hassle for going to an agent or bank branch:

Since the visa virtual card is completely online it doesn’t require you to go to any customer care agent or bank branch, all the processes can be done while sitting in the comfort of your home.

- No hidden charges, Surcharges, or Additional Expenses:

Traditional credit card service may cost you monthly or yearly service charges which again will cost you additional charges but visa virtual service won’t cost you any single penny as a surcharge additional expense.

How to sign up for a Free visa virtual card?

To sign up for your free visa virtual card. First, you need to open the play store and download the Nayapay app. If you have an iPhone you need to do the same procedure but, in this case, you will have to go to app store.

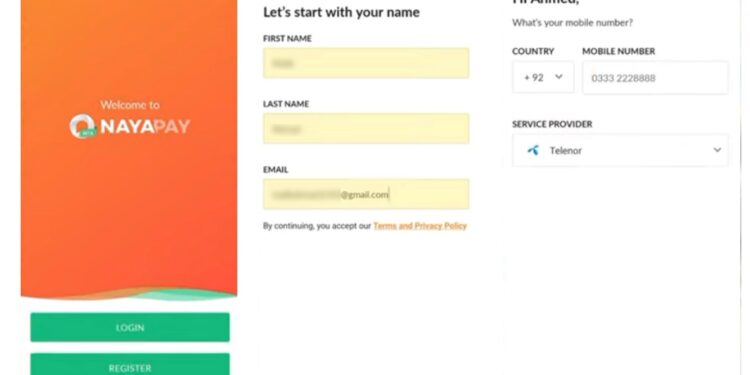

After downloading and installing Nayapay on your mobile

All you need to have CNIC to open your account in a couple of minutes.

- After installing the app open the app and click the login button

- The app will ask for your name, email, and mobile number.

- After successfully providing the information it will ask you to create a unique username name, this username will be used further while sending money to your friends and sharing your Nayapay account you can choose your name as a unique username or add some number if it is already used.

- A prompt will appear telling you that you have made your account. After that, you will have to enter your location and address.

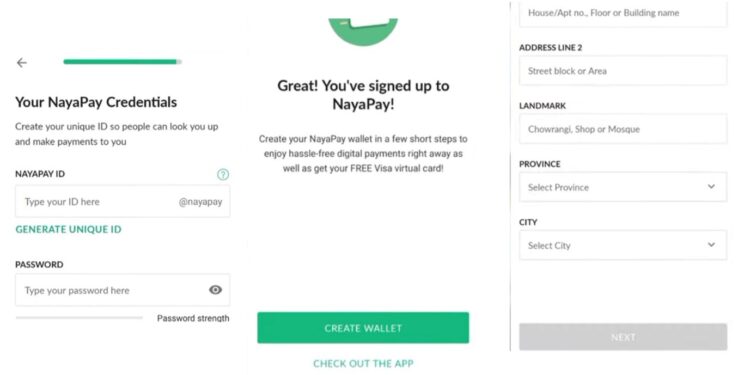

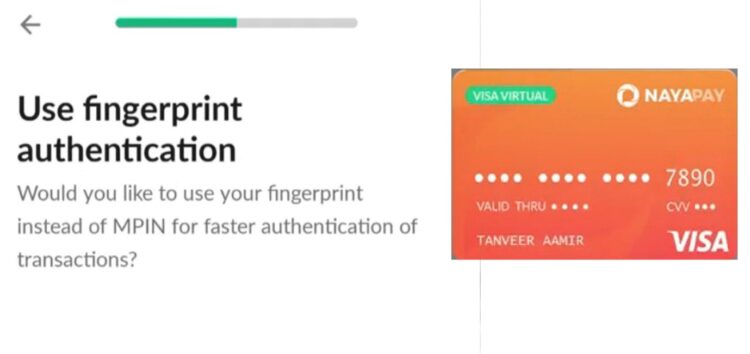

- the app will then ask you to take a clear selfie of yourself as the setup is completely online you don’t need to go to any franchise to register your account.

- Congratulations! your account has been made successfully, now you need to scan your CNIC front and back in the app to upgrade your account.

Applying for a visa virtual card

Now slide to the next tab in the app and you will see your visa virtual card ready with your name written on it.

To activate it you just need to recharge your account with 300 rupees only as a one-time payment but don’t worry this account won’t be counted towards service charges but instead will be added to your Nayapay account so your initial account balance will be going to be 300 rupees.

After that, you are ready to use your visa virtual account and you will be provided with the CVV number and expiry date which will be required when doing an online purchase.

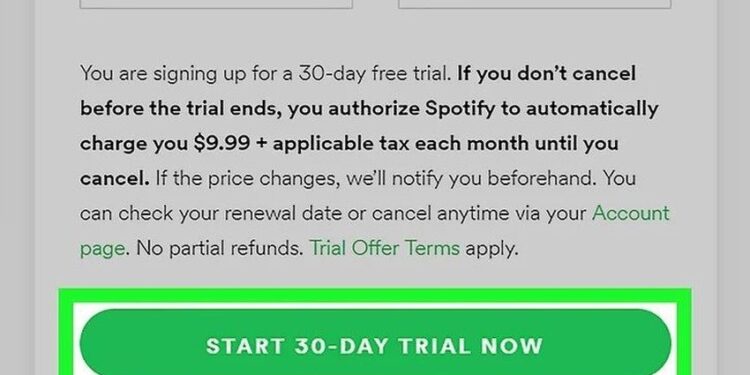

Time to access Spotify and Amazon Prime for free:

Spotify offers a 30-day free trial when paid via online credit card in this case we can also avail of a completely free 30 days trial using our Visa Virtual card.

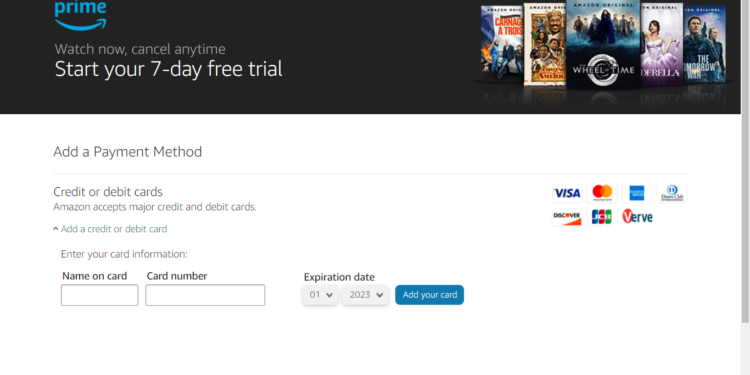

Simply go to the Spotify website and sign up for a free account using your email, then go to the payment tab, enter your card details such as CVV number expiry date, and boom you get a full month of free trial on Spotify. you can repeat the same process on amazon prime video for a free 7-day trial without any payment.

Since you have a working virtual card which will act exactly like a traditional credit card, you can now make purchases all over the world without worrying about leaking your personal information and having access to your salary account. You can also avail free trial on different websites which ask you to just enter your card information such as skype etc. and make your online life more connected and accessible.